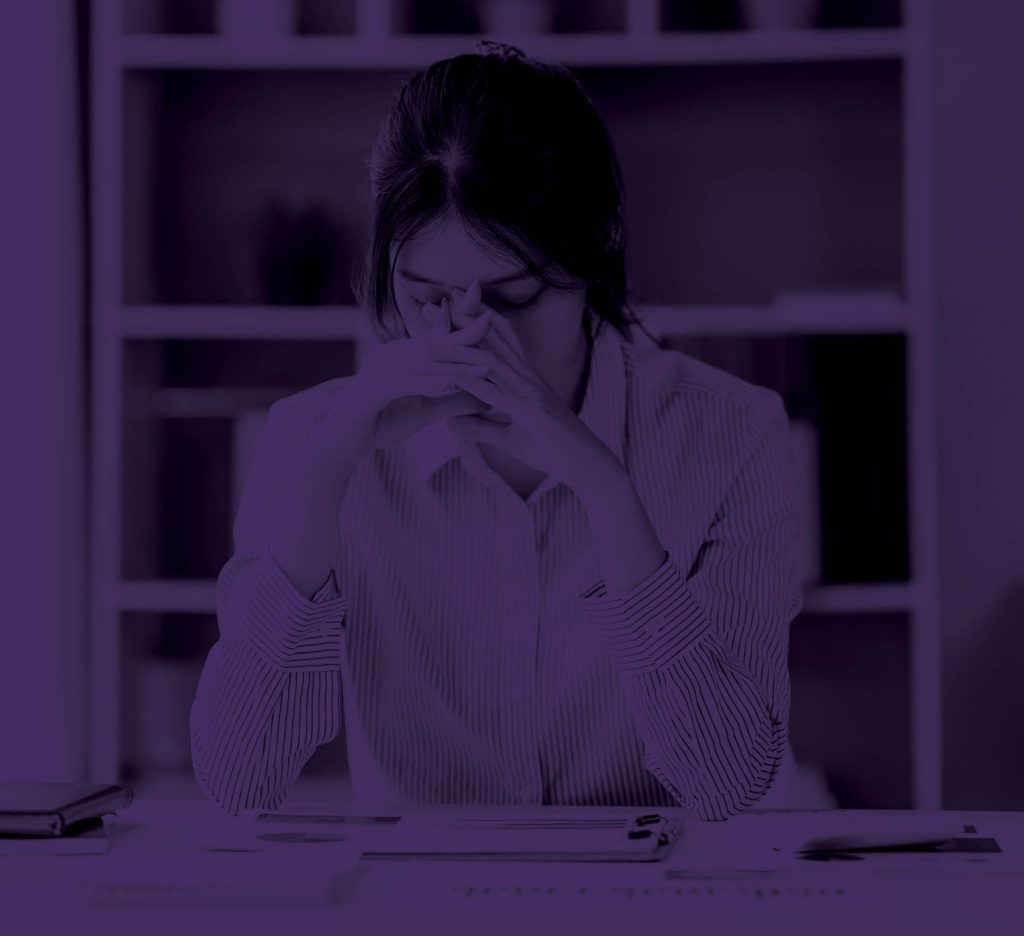

As SMEs approach pay review season for 2025, businesses must carefully balance financial sustainability with the need to retain and motivate employees. Rising costs of living, regulatory changes, and evolving employee expectations are key factors shaping this year’s pay strategies.

This guide explores critical economic trends, salary benchmarking, and alternative reward strategies to help SMEs make informed pay decisions. With 2025 on the horizon, SMEs are facing complex decisions regarding pay reviews. Rising living costs, inflation, and changes to National Insurance (NI) are key factors affecting employee expectations and business affordability. Unlike larger corporations with extensive financial resources, SMEs must balance competitiveness with sustainability.

This white paper explores the economic landscape, industry pay trends, and practical alternatives to traditional pay increases. It provides SMEs with actionable strategies to navigate pay reviews effectively while maintaining financial health and employee satisfaction.

Key Influences on 2025 Pay Decisions

A deep understanding of economic conditions is essential for businesses conducting pay reviews. SMEs should assess broader financial trends, legislative changes, and employee expectations before finalising salary adjustments.

Understanding the broader economic landscape is crucial for SMEs to make informed pay review decisions. While employees expect pay increases to keep up with inflation and the cost of living, businesses must balance this with financial sustainability. Below are key factors that will shape pay review strategies in 2025, along with actionable insights on how SMEs can adapt.

Changes to Maternity Leave and Family-Friendly Policies

The UK government has introduced significant updates to family-friendly policies set to take effect in 2025. These changes reflect a shift towards greater work-life balance and enhanced employee rights, particularly for working parents and carers. Key updates include:

-

Extended Statutory Maternity and Paternity Leave: Parents will now have enhanced flexibility in how they take their leave, with additional weeks available in specific circumstances.

-

Shared Parental Leave (SPL) Enhancements: Revisions to SPL make it more accessible, allowing parents to take time off more flexibly without the previous administrative burden.

-

Carer’s Leave Act Implementation: Employees with caring responsibilities will be entitled to up to one week of unpaid leave per year, providing crucial support for those managing work and caregiving duties.

-

Flexible Working as a Day-One Right: Employees will no longer need to wait 26 weeks before requesting flexible working arrangements. Employers must handle such requests more transparently and consider them in good faith.

SMEs should review their HR policies to ensure compliance with these changes and proactively communicate these benefits to their workforce, enhancing retention and engagement. The UK government has introduced various enhancements to family-friendly policies, including increased flexibility for maternity leave, paternity leave, and shared parental leave. These changes may impact workforce planning and pay review strategies for SMEs. Key updates include:

-

Extended statutory maternity and paternity leave entitlements.

-

Increased rights for carers, including additional unpaid leave allowances.

-

Greater flexibility in requesting part-time or hybrid work arrangements post-maternity leave.

SMEs should factor these changes into their pay and benefits strategies to ensure compliance and maintain employee engagement.

Cost of Living and Inflation

Employees are increasingly concerned about the cost of living, which directly impacts salary expectations. Two key inflation indicators shape pay review considerations:

-

Retail Price Index (RPI) – Historically higher than other inflation measures, RPI has hovered around 5% in early 2025.

-

Consumer Price Index (CPI) – Lower than RPI but still significant in affecting employees’ purchasing power.

While inflation is expected to stabilise, employees will anticipate salary adjustments reflecting recent cost increases. SMEs must assess their ability to meet these expectations without jeopardising financial stability.

National Insurance Contribution (NIC) Changes

The UK government has introduced significant changes to National Insurance Contributions (NICs) in 2025 that will impact both employers and employees. These changes mean that payroll costs will vary for each business depending on workforce composition, salary structures, and eligibility for allowances. Key updates include:

-

Employer NIC Rate Increase: The rate of employer NICs (secondary Class 1 NICs) will increase from 13.8% to 15%, resulting in higher payroll costs for businesses.

-

Secondary Threshold Reduction: The earnings threshold after which employers become liable to pay secondary Class 1 NICs will decrease from £9,100 per year to £5,000 per year, increasing the number of employees subject to NIC contributions.

-

Employment Allowance Increase: The Employment Allowance, which allows businesses to deduct a certain amount from their employer NICs bill, will increase from £5,000 to £10,500, offering some relief to smaller businesses.

-

Employment Allowance Threshold Removal: The £100,000 NICs bill threshold for Employment Allowance eligibility will be removed, meaning more employers can now claim this benefit.

-

Class 1A and 1B NIC Rate Increases: NIC rates on expenses and benefits provided to employees will rise from 13.8% to 15%, increasing costs for businesses offering such benefits.

Each payroll will be affected differently, and businesses should seek professional advice where needed to ensure they are making informed and financially sustainable decisions regarding pay reviews and budget planning. The UK government has introduced significant changes to National Insurance Contributions (NICs) in 2025 that will impact both employers and employees. Key updates include:

-

Employer NIC Rate Increase: The rate of employer NICs (secondary Class 1 NICs) will increase from 13.8% to 15%, resulting in higher payroll costs for businesses.

-

Secondary Threshold Reduction: The earnings threshold after which employers become liable to pay secondary Class 1 NICs will decrease from £9,100 per year to £5,000 per year, increasing the number of employees subject to NIC contributions.

-

Employment Allowance Increase: The Employment Allowance, which allows businesses to deduct a certain amount from their employer NICs bill, will increase from £5,000 to £10,500, offering some relief to smaller businesses.

-

Employment Allowance Threshold Removal: The £100,000 NICs bill threshold for Employment Allowance eligibility will be removed, meaning more employers can now claim this benefit.

-

Class 1A and 1B NIC Rate Increases: NIC rates on expenses and benefits provided to employees will rise from 13.8% to 15%, increasing costs for businesses offering such benefits.

These changes mean that SMEs must carefully review their payroll budgets and factor in higher employer NIC costs when planning pay reviews. Businesses should also consider whether they are eligible for Employment Allowance to offset some of these increased expenses. The UK government has introduced NIC reductions for employees, slightly increasing take-home pay. However, employer NI contributions remain at 13.8%, continuing to be a significant cost burden for businesses.

Although these changes offer minor relief, they do not replace the need for thoughtful compensation strategies.

Industry Pay Trends and Benchmarks

Many large organisations are planning pay increases of 4-6% in 2025, setting expectations for employees across industries. However, SMEs must consider affordability when determining their own salary adjustments.

A strategic approach is essential—one that balances competitive pay with business sustainability.

Beyond Salary Increases: Alternative Compensation Strategies

Given budget constraints, SMEs can explore alternative incentives to maintain competitive compensation packages. Non-monetary rewards can improve job satisfaction and retention while minimising financial strain on the business.

To remain competitive while managing budget constraints, SMEs should explore a mix of financial and non-financial rewards. Employees value different aspects of compensation beyond just salary increases, so businesses should consider personalising their rewards approach to attract and retain talent effectively. Instead of automatically implementing salary increases, SMEs can explore a variety of alternative compensation models that align with employee preferences and financial feasibility.

Performance-Based Bonuses and Commission Structures

Performance-based incentives allow SMEs to reward high performers without committing to permanent salary increases. Implementing structured bonus schemes tied to business profitability, individual performance, and customer satisfaction metrics ensures that employees are motivated while the business remains financially stable. Implement a structured bonus scheme based on:

This model ensures that pay increases correlate with business success rather than being a fixed expense.

Additional Paid Leave and Holiday Flexibility

Providing extra paid leave can be a cost-effective way to boost employee morale. SMEs can offer additional annual leave days or implement flexible working arrangements, helping employees achieve a better work-life balance while reducing turnover.

Other schemes to consider:

-

Buy/Sell Holiday Schemes – Employees can purchase additional leave days or sell unused leave back to the company.

-

Increased Holiday Entitlement with Length of Service – Reward long-term employees with extra leave days as they reach milestones in their service.

-

Flexible Bank Holidays – Allow employees to swap public holidays for personal or religious observances.

-

Birthday Leave – Offer employees an additional day off for their birthday as a valued benefit. Providing extra paid leave can be a cost-effective way to boost employee morale. SMEs can offer additional annual leave days or implement flexible working arrangements, helping employees achieve a better work-life balance while reducing turnover. SMEs can offer:

-

2-5 extra days of annual leave in lieu of a pay increase

-

Flexible working arrangements to improve work-life balance

Enhanced Employee Benefits Packages

A well-rounded benefits package can be just as valuable as a salary increase. SMEs can enhance pension contributions, offer private healthcare, and introduce Employee Assistance Programmes (EAPs) to support employees’ mental and financial well-being. SMEs can introduce:

-

Employer pension contributions above the legal minimum

-

Private healthcare and wellness programs

-

Employee Assistance Programmes (EAPs) for mental and financial well-being

Career Development and Training

Investing in employee growth can enhance job satisfaction and retention. SMEs can provide access to leadership training, professional development courses, and mentorship programs to support long-term career progression. Businesses can invest in:

-

Professional development courses

-

Leadership training programs

-

Internal mentorship and coaching initiatives

Profit-Sharing or Equity-Based Compensation

Tying rewards to business success fosters a culture of ownership. SMEs can implement profit-sharing schemes or share option plans, giving employees a direct stake in the company’s long-term growth and profitability. SMEs can introduce:

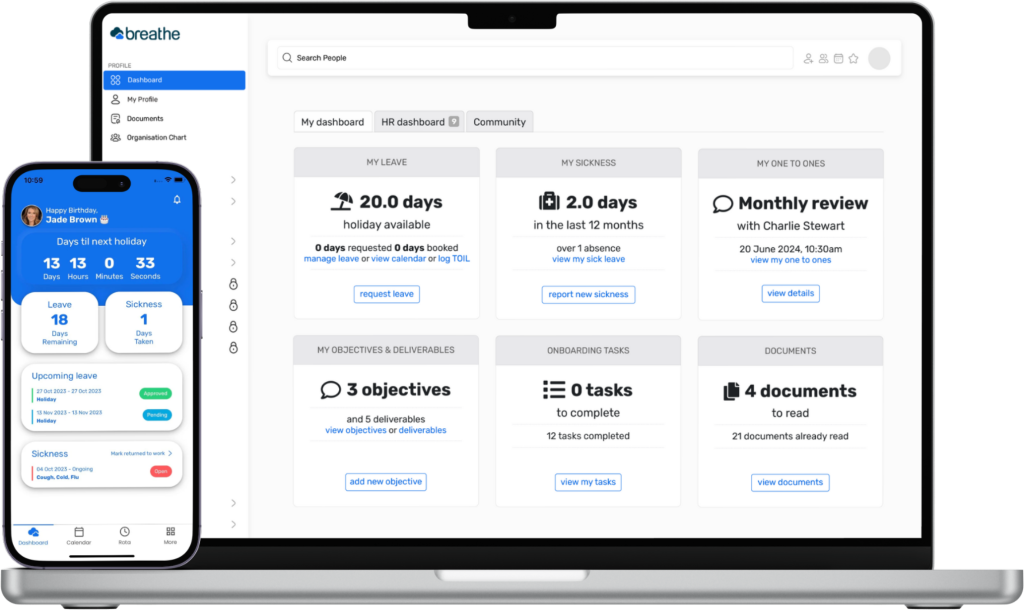

Implementing an Effective Pay Review Process

To structure a fair and sustainable pay review process, SMEs should adopt a systematic approach. This ensures that decisions are data-driven, transparent, and aligned with both business goals and employee needs.

Implementing an effective pay review strategy requires careful planning and execution. Below is a detailed, step-by-step guide to help SMEs conduct a structured and informed pay review process. To successfully navigate pay reviews in 2025, SMEs should follow a structured approach:

Step 1: Assess Business Financials

-

Conduct a thorough financial review, including revenue projections, profit margins, and cost forecasts.

-

Identify areas where budget can be allocated towards salary adjustments or alternative benefits.

-

Establish a compensation budget that aligns with business goals and cash flow stability.

-

Evaluate current revenue and projected profitability.

-

Determine affordability before committing to pay increases.

Step 2: Benchmark Against Industry Standards

Step 3: Engage Employees in the Process

-

Conduct anonymous employee surveys to gather insights on salary expectations and preferred benefits.

-

Hold open forums or one-to-one discussions to better understand workforce needs.

-

Create employee focus groups to test and refine different reward strategies before implementation.

-

Conduct internal surveys to understand what employees value most.

-

Use insights to tailor compensation and benefits packages.

Step 4: Communicate Transparently

Step 5: Implement a Staggered Approach

-

Introduce incremental salary adjustments rather than one-off large increases.

-

Roll out new benefits or bonuses in phases to manage financial risk effectively.

-

Evaluate the impact of the first phase before committing to further pay increases.

-

If affordability is a concern, explore phased salary increases.

-

Combine modest pay rises with non-monetary benefits.

Final Thoughts

SMEs must navigate 2025 pay reviews strategically, balancing financial constraints with employee expectations. By integrating salary benchmarking, alternative benefits, and clear communication, businesses can create a sustainable and competitive compensation model. SMEs must take a strategic, balanced approach to pay reviews in 2025. While economic factors may push employees to seek higher salaries, businesses have multiple options beyond direct pay increases.

By combining competitive salaries with alternative benefits—such as bonuses, additional leave, career development, and profit-sharing—SMEs can maintain employee satisfaction while protecting long-term financial sustainability.

At Kingswood Group, we help businesses design tailored pay and reward strategies. If you need support in structuring your 2025 pay review process, contact us today to explore bespoke solutions that align with your business objectives.

About Kingswood Group

Kingswood Group provides expert HR solutions tailored to SMEs. We specialise in pay and benefits strategy, compliance, and employee engagement. Our mission is to help businesses build high-performing teams through effective HR planning.

For more insights, visit Kingswood Group or contact us to discuss your pay review strategy for 2025.